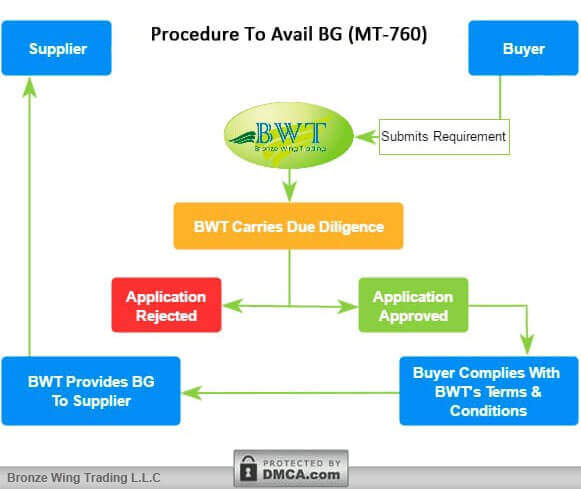

We, Bronze Wing Trading L.L.C. the Bank Guarantee Providers in Dubai can assist you by providing Bank Guarantees – BG MT760 from European Banks at ZERO Collateral. To obtain BG MT760 from rated banks, please follow the simple process given below:-

A Hong Kong trader required a Guarantee to conclude their machinery import deal with German supplier. We blocked our bank limit on behalf of the trader & provided the required Bank Guarantee with the help of our own bank facility available with European Bank.

Also called a Bank Guarantee or BG MT760, it’s issued by a bank on behalf of its client upon their request. If a client wants to enter into a new project or trade deal, then they require a Guarantee to assure their commitment towards their counterparties. In this case, the client contacts their bank to avail BG MT760. The issued BG acts as a promise to assure the counter party, that in case of buyer’s default, the bank will meet all financial obligations as stated in the contract.

As BG gives required assurance, most of the trade dealings happen with the use of Bank guarantees. Further, this BG MT760 helps traders to do business & execute trade deals with big companies which couldn’t be possible without the use of a Letter of Guarantee. All these make Bank Guarantee, the popular financial instrument in today’s trade market.

To issue an MT760, your bank will demand you to block a 100% cash margin or a third party assurance. If you don’t have enough cash funds to block as collateral, then your BG request will be declined. We are well aware of the crisis faced by traders and contractors in availing MT760. That’s why we support them by extending our bank facilities on their behalf and provide the required MT760 guarantees without blocking their cash funds.

When importers / exporters get connected to do business, Trust is the glue that holds both parties. In such cases, the trust is easier to maintain, if a third party stands as a guarantor to bear any unforeseen crisis.

BG MT760 acts as an agreement between 3 parties, viz. the applicant, the recipient, and the bank. Whereas, the bank promises to cover a loss; if a buyer defaults. So by this, BG promotes trust between traders; which greatly encourages them to conclude their deal.

For example: If a project owner is going to sign a construction contract with the contractor or a buyer enters into a contract for the supply of goods; then they require a Bank Guarantee to assure their commitment in terms of payment to their counter party. This gives assurance that the contractor will complete the task without any hurdles. In case of any default, the bank obliges to meet the commitment as agreed in the contract. However, it doesn’t give any guarantee to any party regarding the completion of a project or the supply of goods and so on.

In case of any default in the contract and if the counter party needs to claim the payment means, then the BG needs to be liquidated. To claim the BG, the seller or the contractor needs to submit the required documents to the banks as per the contract terms. The banks will review the documents and if it complies, then they will make the payment as compensation to the counter party.

In BG, three types of parties involved:-

Since banks take the commitment on behalf of the clients, the applicant needs to prove their creditworthiness to their banks to avail BG. Banks will also do a proper background check of the applicant and make an account of credit history, liquidity, past transactions, and so on.

Even if the applicant complies with all these terms, they will demand a certain percentage of the guarantee value as cash margin, assets as surety, or third party assurance. The bank will start working on your BG request, only if the client obliges to all the terms and conditions of the bank.

If you are a buyer or contractor who requires Bank Guarantee & if you don’t want to tie up your working capital in a single deal, then you can contact us. To apply BG MT760 on your behalf, without any cash margin, fill out the formfill out the form. We provide BG MT760 from rated banks within 48 working hours.

Issued for honoring a project or task and completion of the same in the specified time frame as agreed in the contract.

Ensures that they will return the advance payment in case of non fulfillment of terms as per the contract.

Assures that the winning bidder will undertake the project & abides by the terms of the contract.

The cost of BG MT760 includes the commission fee, transmission fee & processing & handling charges. Further, to know more info on costs & other tariffs, contact us!

Bronze Wing Trading L.L.C. is an International Bank Guarantee provider in Dubai. We can provide BG MT760 on behalf of traders and contractors without obtaining any collateral from your end.

With our decades of expertise in offering trade finance services, we can assure you that we can provide you the right solution to conclude your deal in a timely way. Further, we will be the one-stop solution for all the Bank instrument requirements of a growing trader.

Having BG MT760 in hand can assist you to conclude more worthy trade deals and contracts with principal suppliers. So, apply for BG MT760 now & get it issued in 48 banking hrs!

The Website Content is DMCA Protected.