You can open Documentary Letters of Credit on behalf of your company at ZERO Cash Margin by contacting us. We are the Trusted Letter of Credit Providers in Dubai.

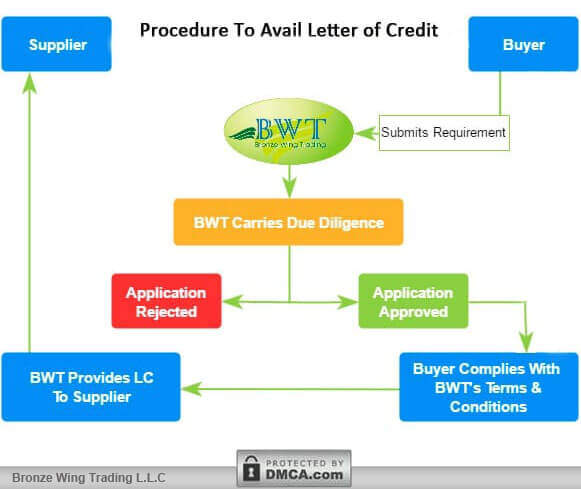

Follow the simple Letter of Credit Issuance process to open Import LC at ZERO Cash Margin:

A Sudan-based trader required a Letter of Credit facility to finalize their Toyota Hilux Double Cabin Pickups import deal with a Dubai supplier. We extended our own bank facility available with European Banks and facilitated the required MT700 from our European Bank Account at ZERO Collateral!

A Letter of Credit is a written undertaking issued by a bank assuring the buyer’s payment towards the seller. It is also called irrevocable LC, Import LC, LC at Sight, LC MT700, DLC MT700. This is to assure the seller that they will receive the payment for the supply of goods, once they submit the shipping documents.

Due to the nature of global trade dealings & its risks factors including distance, different laws in each country, and trust issues between the traders, the use of Letter of Credit has become a vital part of global trade. When a buyer & a seller from two different parts of the world decided to do business, there might be uncertainty in trust and payment will arise. To bridge the gap between the traders & to build trust, Letters of Credit are being used.

Usually, Import LC & LC at Sight which is valid for 90 days and 180 days is always irrevocable. It means a bank provides an irrevocable commitment to the seller, that they will get paid if they comply with the terms stated in the issued Irrevocable Letter of Credit. Also, it assures that if the buyer is unable to make the payment or went bankrupt, then the bank will be liable to fulfill the payment terms as agreed in the contract. Hence this is an irrevocable commitment made by the bank, Letters of Credit are mostly preferred by buyers and sellers, as an LC Payment Term in International Trade.

When it comes to global trade, buyers run the risk of not receiving goods from the seller for which they have already paid. On the other hand, sellers run the risk of nonpayment by the buyer for the supplied goods. Hence, in this case, the traditional payment method used earlier for global trade has failed. So, the International Chamber of Commerce (ICC) introduced MT700 to secure the interests of both parties involved in trading.

While using LC Payment Term, the buyer’s bank assures to pay the seller for the supplied goods; upon complying with all terms & the submission of documents as stated in the issued Letter of Credit. In case, if the seller fails to submit the documents before the deadline, the LC will be expired. Then the bank will return the funds to the buyer’s bank account which they deposited while LC Opening. Hence, this way, the risk of default in the payment & the delivery of goods goes down to zero percent.

To open a Letter of Credit on behalf of your company at ZERO Cash Margin, you need to arrange the following paperwork:-

Once all these documents are received from your end, you can contact us with your LC request. And we will start work with our bank to structure your Letter of Credit transaction.

In general, the following are the parties involved with Letters of Credit. Here’s what each party role and what it does:-

Applicant: The Applicant or the buyer who requests the bank to issue the LC MT700 in favor of their supplier.

Beneficiary – The seller who receives the MT700 in their bank account, called LC Beneficiary.

Issuing Bank – The bank who issues the MT700 on behalf of their customer, called LC Issuing Bank.

Advising Bank – The advising bank receives the MT700 from the issuing bank and advises the LC towards the seller’s bank.

Negotiating Bank – The seller’s bank who receives the LC works also as a negotiating bank on their client’s behalf.

Not just the buyer, but the seller also gains lots of benefits by using Import LC as a payment term. And it includes:

This type of Letters of Credit cannot be amended or changed without the consent of all parties involved. Most of the traders prefer Irrevocable LCs. This is because Irrevocable LC gives the security that most suppliers want.

As it says, this can be transferable to the principle party upon request of the 1st beneficiary. This is because, in some cases, the first party is playing the role of a middle party under this type of Letters of Credit.

In some cases, sellers may not trust issuing bank that provides LC on behalf of the buyer. Hence, they might require a bank in their home country to confirm the LC.

This type of LC is commonly used in domestic and global trade. Also, this guarantees that the bank will release the payment; once the seller submits all the documents as mentioned in the credit.

This type of Letter of Credit Back to Back normally issues against the Master LC. This is to say, here, at first, the LC opened in favor of an exporter from an importer’s bank. Then, on the basis of the Master LC and the credit facility available in the exporter’s account. Further, the exporter’s bank will open a new LC, in favor of their principal seller.

The cost of Letters of Credit may vary based on the amount & its tenure. Usually, the cost may include bank commission, processing fee & swift charges. Further, the cost is borne by the Applicant (buyer). Also, it should be clearly stated on the issued LC. For more info on the Cost, Contact us.

Bronze Wing Trading L.L.C., the Letter of Credit Providers in Dubai provides LC MT700 on your behalf without any cash margin. By offering Letters of Credit from rated banks, we help traders who do not have enough credit lines in their bank account to conclude their trade.

If you are looking for a secure, easy, and reliable way to get MT700 to conclude your trade, Fill up the Form Available Here!Fill up the Form Available Here! We can provide you with the required LC at Sight from European Banks at Zero Cash Margin!

The Website Content is DMCA Protected.