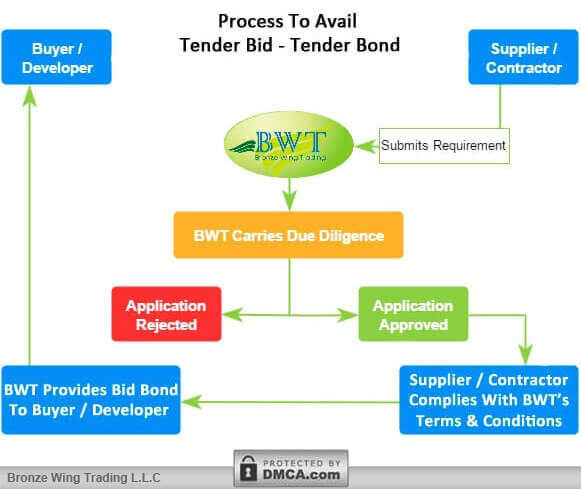

Do you require Bid Bond – Tender Guarantee to submit your tender for the upcoming bidding contest? Follow the simple steps to obtain Tender Bond without blocking cash funds.

A Construction Company in the UAE contacted us with a request to get Bid Bond Worth USD 830,512 in favor of their developer. To assist them, BWT facilitated a BG from our bank by blocking our own bank limit. With the guarantee, they won a bidding contest & signed the contract for a high-rise building construction.

Bid Bond – Tender Guarantees are issued by banks on behalf of contractors and in favor of project owners. This assures that the winning bidder will undertake the project or supply contract; as per the agreed terms of the bid.

Bid Bonds act as a guarantee that a contractor or seller will honor the terms of the bid. This also shows the proof that they are financially stable; have the required sources to take on the project or supply contract. Even more, the main purpose of these Bonds is to show that they are capable to provide a Performance Bond; if awarded with a bid.

Without Bid Bonds, project owners & buyers have no other way of guarantee that the winning bidder would be able to complete the job as per the bid terms. That’s why almost all project owners and buyers demand a bond from bidders; before they submit their bids on projects or supply contracts.

As a result, Bid Bonds act as a security for bid proposals – especially for large projects such as high-rise building construction or bulk goods supply. Further, filing the tender without the required bond will make the contractor automatically disqualified from the bidding process. So, make use of Bid Bonds to win more trade deals and contracts.

Bid Bonds play a vital role in both the construction and trade industry. When a contractor or a supplier submits their tender for a construction project or a commodity contract; they will submit their bid along with Tender Guarantee. This enhances the chance of winning the bidding contest by giving the assurance that the winning bidder will honor the terms of the bid & will undertake the project without any default.

Also, it gives assurance to the counterparty, that in case if the bidder fails to honor the terms of the bid, then they will be compensated. For instance: if the contractor or seller raises the price of the job or supply of goods after signing the contract, then they must obtain the consent of the concerned parties. With mutual consent, the prices can be revised. Also, to be noted that no one is authorized to revise the quotation, unless or until all concerned parties are agreed upon it. This is the vital point wherein the Tender Bond secures all parties’ rights.

Nowadays, almost all project owners demand such bonds from bidders to secure themselves from defaults. By submitting a tender along with this bond, the contractor / seller will qualify to enter into the bidding process. Also, the project owner or buyer can easily find the right party to complete the job. So, as a contractor / seller you require this type of bond; if you want to sign more projects or supply contracts in the construction or trade industry.

Mostly, at first instance, project owners aren’t aware whether the bidder can complete the project or not; if awarded. So, they demand this Bond from the bidders; as this bond assures that the winning bidder will complete the project as per the signed contract without any default.

Project owners mostly demand Tender Guarantees to act as a security against the risk of the successful bidder failing to enter into the contract. When a project owner decides to bid out, they will often exclude the bidders without Bank Guarantee. Because the project owner needs to hire the one whom they can trust. Also, they want to ensure that the bidder is fully capable to perform the task, in case, if they win the bid.

So, the only bidder who submits their tender along with the guarantee will be qualified to enter into the tender process. Do you require Tender Bond to get pre-qualified to enter into the contest? Contact us today! We will help you with the provision of BG MT760 from rated Banks with International Repute. Further, in case, if you want to see, if you can qualify for Bid Bonds; discuss with us now!

Applicant – Contractor / seller who requests a tender guarantee from their bank.

Beneficiary – Project owner / buyer who demands & receives a Bond from a seller / contractor.

Issuing Bank – The Bank which issues a Tender Bank Guarantee on behalf of the contractor and seller by assuring the project owner and buyer; that the winning bidder will honor the terms of the bid; without any default.

When it comes to availing Bid Bonds, you will likely need to secure a Bond for the specific percent of the total quoted contract value (said about 5-10%). This means if you’re going to bid for a project worth $100,000. Also, if you’re asked to provide a 10% means; then you need to secure a Bond of the value of $10,000. On the other hand, the value may also vary based on the project and project owners’ demand.

If you contact your bank to apply Bid Guarantee; then they will demand you to provide 100% of the bond value as cash margin. In case, if you are unable to meet the banking terms, then they will decline your request; also, obviously, you will lose your chance to enter into the bidding process to bid on the contract or project.

So, to help bidders who face cash flow issues in getting the required bonds from their bank, we are here to support them. Just Submit your Requirements Submit your Requirements to us and avail the required tender guarantee issued at nominal cost. Unlike banks, we will not demand you to provide a cash margin or to block your cash funds to issue the MT760 Guarantee.

The cost may vary based on the total contract value and also based on its tenure. It also includes admin fees, issuance fees, handling charges, & so on. To know more about costs, contact our team!

Are you looking to participate in a tender for an upcoming project or supply contract?

Do you want to become pre-qualified to enter into the bidding contest?

Submit your bid along with a Tender Bank Guarantee to increase your chance of winning the contest! To avail Bid Bonds, Contact us today!

We, the International Bank Guarantee Providers in Dubai provide Bid Bonds from rated banks without draining your cash funds. Our company has bonded thousands of projects with over 30 yrs. of experience and expertise.

Avail Bid Bond GuaranteeBid Bond Guarantee from us to win more bids & sign more contracts!

The Website Content is DMCA Protected.