Being the direct SBLC Provider, we can support imports and exports by providing Standby Letter of Credit – SBLC MT760 on behalf of importer and in favor of the exporter to conclude their trade deals.

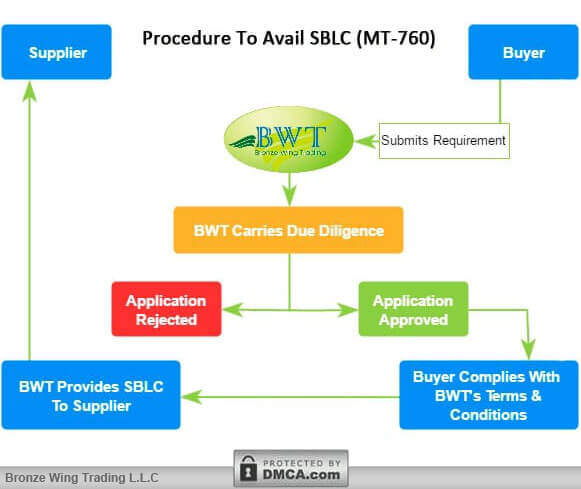

To avail SBLC from us, follow the simple process given below:

A Sugar Importer in Dubai required a trade finance facility to close their Sugar import deal with their Brazilian Supplier. We facilitated the required Standby LC at ZERO Collateral by extending our bank facility available in European Bank Account. With the issued SBLC MT760, the deal concluded successfully within 48hrs.

A Standby Letter of Credit (SBLC) is a written undertaking issued by a bank on behalf of its client. SBLC guarantees the bank’s commitment of payment to the seller, in the event of the buyer defaults. Considered as a “payment of last resort”, SBLC assures that the bank fulfills the payment obligations; in case if the client fails to oblige with the contract terms.

Standby Letters of Credit certifies the credit worth and payment strength of the buyer. Also, it helps to facilitate global trade between companies that don’t know each other and have different rules & regulations. Therefore, traders mostly preferred to use this financial instrument as it gives the required payment guarantee.

Moreover, MT760 can also be used for the purpose of Collateral for Credit Enhancement. Thus, it will help traders who plan to expand their business, without giving up their cash funds. Having SBLC improves the company’s cash flow & seen as a sign of good faith. Further, SBLC allows traders to use their cash capital for other dealings before payments become due.

Are you looking to get Standby LC for your domestic purchase? Contact Bronze Wing Trading L.L.C. SBLC Providers in Dubai! We can extend our bank facilities from European Banks and will issue the required MT760 at ZERO Collateral.

A Standby LC can add a safety net to both local and global transactions by assuring payment for the completed service or the supply of goods. With such an agreement, the bank guarantees the payment towards the seller, if any unforeseen happens. The SBLC describes the different situations which could cause the bank to pay.

For instance – A seller supplies the goods to the buyer who promises to make the payment within 30 days of shipment. If the payment never arrives, then the seller can claim the SBLC to the buyer’s bank to get the payment released.

Since the buyer’s bank takes the responsibility to pay the seller in case of default; before issuing the Standby, the buyer’s bank typically evaluates the buyer’s creditworthiness & repayment skills. If the credit score of the client is low, then the banks may require collateral or funds to deposit to get the SBLC issued. In case, if you can’t able to fulfill the demand of the bank, then the bank will not proceed further with your SBLC request.

But we, the SBLC Providers in Dubai understand the financial crisis faced by the traders; and also, we assist them to avail SBLC MT760 from our bank account without cash margin.

When two parties (buyer & seller) agree to use Standby LC as their payment term to conclude their trade deal. Then, the buyer has to open Standby LC in favor of the supplier from their bank. By issuing Standby LC in favor of the supplier & on behalf of the buyer, the bank guarantees the payment – even if the company closes down, declares bankruptcy, or unable to pay for goods and services provided.

For instance, if the buyer defaults, the seller has to present all documents mentioned in the issued SBLC to their bank. The bank verifies all the documents, and if it complies with the terms, they will pay the seller’s bank the amount due.

The main advantage of having SBLC is the potential ease of getting out of that worst scenario. E.g. If a contract calls for payment within 60 days of delivery and if the payment is not made means, then the seller can present the SBLC to the buyer’s bank for payment. This assures guaranteed payment for the seller. Hence, SBLC reduces the risk of the production order being changed or canceled by the buyer.

Standby LC provides a lot of benefits for both importers and exporters which we have listed below:-

Standby LC can be transferable if it’s subjected to the terms. This is a question that most of our clients ask before availing the MT760. Like other bank instruments like cheque, promissory note, etc. can transferrable in good faith. Likewise, MT760 can be transferred in favor of a second SBLC recipient. However, it requires a written request by the first SBLC recipient. And, at the same time, the approval of the issuing bank.

Generally, the applicant (buyer) borne the cost for the issuance of SBLC. Mainly, the cost includes – bank commission, processing fee, and transmission fee. All these charges paid by the importer at their bank as per the agreed contract between the buyer & the seller. To get more details on our tariff, Contact Us

Bronze Wing Trading L.L.C., SBLC Providers in Dubai extend their facilities to provide SBLC MT760 from European Banks; on behalf of buyers to give the required payment assurance towards their suppliers.

Our trade finance experts will frame the SBLC MT760 as per your requirement & will help you to conclude the trade deal within 48 working hours.

To avail Standby Letter of Credit from rated banks, submit your requirements to us!submit your requirements to us! We will get back to you ASAP!

The Website Content is DMCA Protected.